Observations:

-SPX & NDX closing in on the 200SMA on daily, wedging at the 24% fib (RUT bounced is above it's 200SMA)

-Dollar broke out and is uptrending toward 84, RSI is 82.3

-Crude sitting on 90 UTL support on the weekly

-TLT triple top? Also negative divergences at this retest

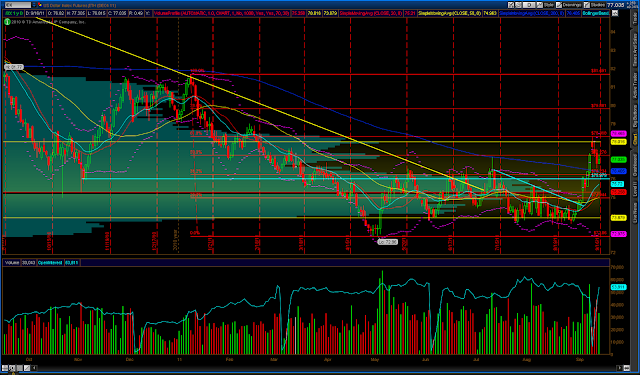

- AAPL at DTL resistance will need for it to break up and hold 50% fib (570) for any meaningful rally in the markets with next resistance around 580-582.

- VIX is uptrending holding above 20

-McClellan Oscillator is down trending

SPX (Daily, 30 minute)

NDX (Daily, 30 minute)

RUT-X (Daily, 30 minute)

Dollar (Daily)

Crude (Daily)

TLT (Weekly, Daily)

Gold (Daily)

AAPL (Daily, 30 minute)

VIX (Daily)

McClellan Oscillator