Market Read

Whether the news out of the Europe is for real and the bailouts/money printing/can kicking continue the market still has not convinced me that risk is all clear through year end. This next few weeks should be very interesting and telling where we go from here.

Right now I am more "neutral" biased for the foreseeable future. Global macro indicators continue to deteriorate while conversely we're getting more Central Bank action and speculation. As an intraday trader I need to constantly recite the mantra "trade what you see not what you think".

Right now I am more "neutral" biased for the foreseeable future. Global macro indicators continue to deteriorate while conversely we're getting more Central Bank action and speculation. As an intraday trader I need to constantly recite the mantra "trade what you see not what you think".

Finviz US econ calendar: http://finviz.com/calendar.ashx

Weekend update on European situation: http://www.calculatedriskblog.com/2011/09/europe-update-little-progress.html

Fed "Twist and Shout" action by John Mauldin: http://www.businessinsider.com/operation-twist-and-the-feds-latest-bailout-of-european-banks-2011-9

ECRI continues to point to a US recession (how can you be in something that isn't really defined): http://www.businessinsider.com/ecri-index-leading-economic-indicators-negative-2011-9

Weekend update on European situation: http://www.calculatedriskblog.com/2011/09/europe-update-little-progress.html

Fed "Twist and Shout" action by John Mauldin: http://www.businessinsider.com/operation-twist-and-the-feds-latest-bailout-of-european-banks-2011-9

ECRI continues to point to a US recession (how can you be in something that isn't really defined): http://www.businessinsider.com/ecri-index-leading-economic-indicators-negative-2011-9

Bullish case:

- Volume during this week's rally was strong

- Tech continues to lead

- Too many shorts in the frying pan

- JNK v. LQD still weak

Daily

- Too many shorts in the frying pan

- AAPL above 400

Bearish case:

- Bear flags still around

- EURUSD lost the 200SMA, high volume sell-off and has Greece default news weighing on it

- Dollar bull flagging

- Dollar bull flagging

- Crude bear flagging looks like its going to be sub 85 before 90+

- Copper breaking down out of bear flag

- Long bond continues to put in higher lows and highs

- VIX still bull flagging

- Gold (fear trade) is still strong

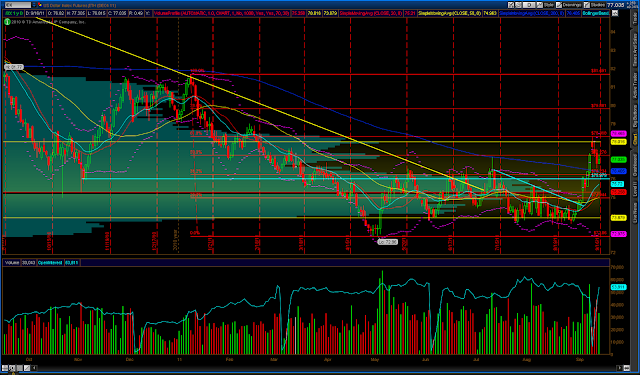

SPX

Weekly

Daily

No comments:

Post a Comment