*These are not in alphabetical order and please excuse any shorthand and grammatical errors.

Daily

Weekly

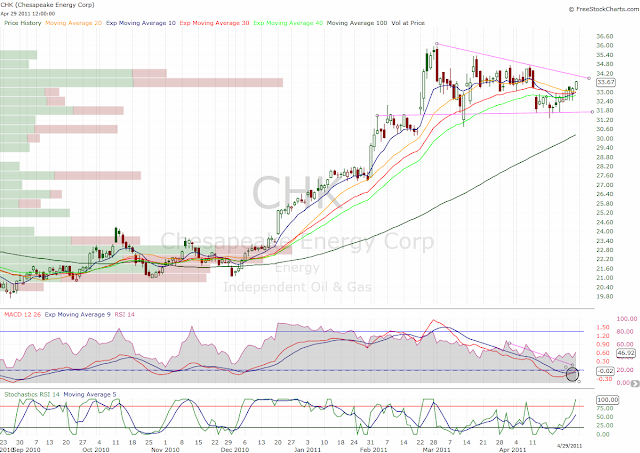

CHK- Reports 05/02/11 A/H. Earnings on Monday going to decide the direction in the break. *have position

CLNE- Building a handle on the daily, MACD rounding up, RSI poking up, Stoch cross up. Watch for a clearance above 50% Fib or 17.85 looking for a move to 61.8% Fib or TL resistance. Reports 05/09/11 A/H. *have position

30 minute

Daily

BSFT- Pull back to the 50MA now forming a Pop drop & chop pattern. Currently basing here like this on a dip to lower TL sup around 43.5 with a 1 point stop or on a break out above 47.5 looking for 60+. Seeing a bullish MACD kiss. Reports 05/09/11 P/M.

GPOR- Pop drop & chop pattern. Looks good. Hoping it can go before earnings. Just noticed that IBD bumped it up on their IBD Top 50 list. Reports 5/5/11 P/M. *have position

BID- Reports 5/5/11 A/H. Forming a nice consolidation base just below the 20MA & supported by the 50MA. MACD looks to be kissing, RSI turning up...

PII- Consolidating/flagging nicely post gap up. Clearly holding the 5EMA. Still like this above 107-107.5.

Daily

30 minute

GEOI- Oil producers look to be setting up. This leader doesn't look too ripe right here right now but added to my watchlist. May try to nibble on a push above 29.2 to see how this oscillating pennant/wedge performs. Bullish volume pattern, just got a bullish MACD kiss, RSI & OBV rounding up. Reports 05/10/11 A/H.

WFC- Possible short idea here on market weakness into this week. Financials have been relatively weak and lagging the overall market for 2-3 years now. Bear flag here, you could take a short here stop out above 29.5or the 8EMA. WFC still range bound from 23-34.5. Low risk high reward setup.

Weekly

Daily

MIDD- PDC pattern and now building a tight base. Like this in sympathy with CAT blowout earnings. Long above 91 or a dip to 89 with maybe a 1-2 pt stop. Looking for 100. Bullish MACD kiss, RSI, Stoch & Stoch RSI all turning up. Reports 05/12/11 A/H.

MSM- Recycled from last week but still building that base:

NDSN- Another diversified machinery name (CAT competitor) that's setting up. Like it on a dip to 56 with a 1-2 pt stop (just under 5/8EMA or TL sup). Bullish MACD kiss, RSI & Stoch all turning up.

SINA- Flagging out, watch for a move above TL resistance. Watch also for tells from BIDU or SOHU. These Chinese stocks seem to be moving in concert lately. Reports 05/17/11 A/H.

GOOG- Tech seems to have bottomed and may start to try to play catch up. Holding that TL support & still in multi-year ascending triangle. May look @ call or Calendar spreads. Looking at weeklies 550/545 vertical call spread.

TOS analytics

VMW- Flagging and holding the 8EMA watch for a decisive move above 99.

AAPL- Betting we see a move in AAPL & tech soon and it makes it back to the highs. Looking at a May (not weeklies)365/360 vertical bull call spread. Right now it looks like a 3:1 RR.

TOS analytics

No comments:

Post a Comment